Why is the US Treasury pumping money into the Deposit Insurance Corporation?

[ad_1]

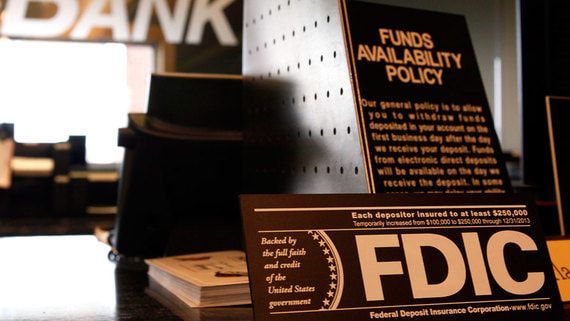

Since the beginning of the new fiscal year, which started in October, the US Treasury has allocated $28.6 billion to support the Federal Deposit Insurance Corporation (FDIC, a structure similar to the Russian Deposit Insurance Agency). And the department allocated half of this money in November. This is evidenced by the latest data from the ministry’s daily report. The last time a sharp increase in FDIC funding was recorded was in March of this year amid the collapse of US banks Silicon Valley Bank (SVB), Signature Bank and Silvergate Bank. Then the Ministry of Finance’s expenses for additional capitalization of the corporation for the month amounted to $69 billion. Over the past few years, the total volume of budget transfers to the FDIC rarely exceeded several hundred million dollars. In the five months from the beginning of FY2023 until the March crisis, they amounted to a total of $314 million. For the entire last fiscal year, total budget expenditures to support the FDIC were estimated at $93.6 billion, most of which were allocated in the spring.

After US government bond rates reached 2007 highs in early October, total unrealized losses of US banks exceeded $650 billion at the end of last month – 15% more than in September, Moody’s analysts estimated. At the same time, agency experts emphasized that the current situation in the banking sector is significantly different from the March turmoil. In particular, SVB began selling its securities after their value fell, resulting in realized losses in the amount of $1.8 billion, which led to a massive outflow of deposit funds and, as a result, the bankruptcy of the bank. Experts do not currently observe a similar situation with large American banks, emphasizing that their losses remain unrealized, i.e., essentially, paper losses.

[ad_2]

Source link