US restricts investment in artificial intelligence and advanced semiconductors in China

[ad_1]

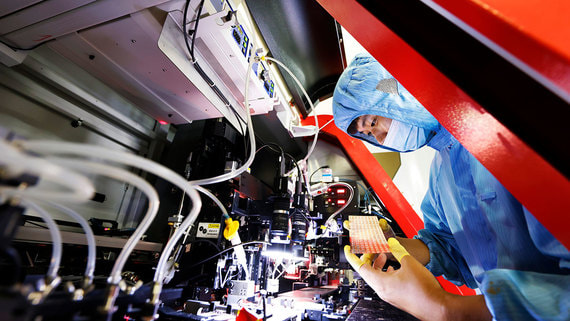

The White House has issued an executive order to limit direct investment in high-tech Chinese companies whose revenues are at least half related to quantum computing, the development of artificial intelligence (AI) and advanced semiconductors. The new measures of the US authorities, which they justify as a threat to national security, were reported on August 9 by The Wall Street Journal (WSJ), The New York Times (NYT) and Bloomberg, citing sources. The announced restrictions will come into force no earlier than 2024 and will not apply to previously received investments from the United States.

According to the WSJ, technically, the new rules will apply to investments in companies in a number of countries that are opponents of the United States, including from Russia, but in practice they will only affect work with China. According to them, American private and venture investors will be prohibited from investing in Chinese companies that are engaged in quantum cryptography, the development of AI and the most advanced semiconductors. At the same time, one of Bloomberg’s interlocutors assures that a complete ban on investment in AI will only apply to Chinese companies that supply products to the military, and in other cases, you will need to notify the government (it is likely that there will be exceptions in the sector of quantum computing and chips). Investors who violate these rules will be at risk of fines and orders to give up their shares, writes WSJ. However, the new rules are not retroactive and do not affect portfolio investment in Chinese stocks and bonds.

According to Bloomberg, the new restrictions de facto limit investments, most likely only in Chinese start-ups and will change practically nothing for American investors who plan to work with large Chinese corporations, since most of their income is not from the high-tech sector. The goal of the White House, therefore, may be to prevent the emergence of new competitors from China in the field of new technologies. According to an anonymous official in the US presidential administration, the restrictions are aimed at stopping US capital injections into industries that could help the Chinese military or government oversight.

Washington’s new move, according to the New York Times, will displease the Chinese authorities. In February 2023, Reuters cited data from the Center for Security and Emerging Technologies (CSET) at Georgetown University, where US investors’ investment in AI in China was estimated at $40.2 billion over the period from 2015 to 2021 (37% of total investment in AI in China). Chinese AI sector).

The initiative fits into the general outline of relations between the United States and China, says Lev Sokolshchik, Research Fellow at the HSE Central Research Institute. According to the US National Security Strategy 2022, China is a strategic rival of the US. That document assumed the containment of China in all key economic sectors, including the development of AI and advanced chips. The rhetoric about ensuring US national security with restrictions against China in the high-tech industry is just a standard wording in a similar context, the expert notes.

“This is not to say that the new White House order is a shot in the head of the Chinese tech sector, since it will be startups that will suffer the most, and not established Chinese tech companies,” says sinologist Leonid Kovacic. It is believed that under the influence of the American technology lobby, which is not interested in curtailing trade and investment cooperation with China, the text of the decree was repeatedly amended in the direction of easing restrictions, the expert adds. The new order will create some inconvenience for Chinese firms that have relied on US venture capital firms, Kovacic said. Chinese companies currently do not have the technology to produce the most advanced chips required, for example, for the development of generative AI. Creating a product comparable to ChatGPT is currently impossible in China due to a lack of computing power, the expert says.

China is now focusing on the production of older-generation semiconductors used in cars and consumer electronics, taking over market share that used to be blurred between different manufacturers. Beijing will continue to look for economic responses, Kovacic says. Among them are further restrictions on the supply of key components, such as the export of rare metals, the expert concludes.

$40.2 billion

total US investors’ investment in AI in China between 2015 and 2021, according to Georgetown University’s Center for Security and Emerging Technologies (CSET). This level of investment is equal to 37% of the total investment in the Chinese AI technology sector.

China has become one of the world’s leading technology players, actively attracting foreign capital, including from the United States, to develop its AI sector and technical equipment, says Konstantin Kotik, head of the NLP R&D team at Just AI. And although China is actively working to achieve technological autonomy in the field of AI, the country is still dependent on foreign funding.

From the point of view of the concepts of American policy, the new “weak” sanctions act not as instruments of economic pressure, but as signals, says Alexander Sivolobov, deputy head of the Skoltech-based NTI Competence Center for Wireless Communications and the Internet of Things. Signal decisions, unlike economic ones, have practically no adverse consequences, but they have a positive effect on the rating of politicians, Sivolobov believes. The new bill did not come as a surprise to the market: work on the decree lasted almost a year, so that all interested parties had time to adapt. Yes, June 2023. Microsoft moved its key AI developers from China to Canada. The flow of direct and venture investments from the United States to China has decreased by more than 3 times since 2019, the expert says.

[ad_2]

Source link