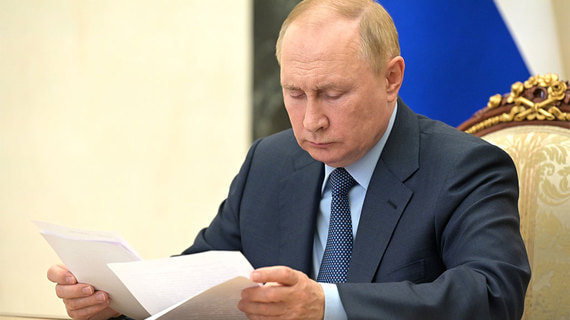

Putin banned transactions with foreign shares in companies in the energy sector and banks

[ad_1]

Russian President Vladimir Putin banned until the end of 2022, transactions with shares of foreigners from “unfriendly countries” in Russian strategic enterprises, fuel and energy companies and banks follow from the decree on special economic measures in the financial and fuel and energy sectors. The document is published on the official portal of legal information.

We are talking about transactions that directly or indirectly entail a change in the rights of ownership, use or disposal of securities, shares in the authorized capital of Russian legal entities, rights and obligations in production sharing agreements, joint venture agreements or other documents on the basis of which investment projects are implemented. in Russia. According to the text of the decree, its validity can be extended an unlimited number of times.

The document was adopted in connection with “unfriendly and contrary to international law actions of the United States of America and foreign states and international organizations that have joined them, aimed at imposing restrictive measures against Russian citizens and legal entities,” the text of the decree says. Its goal is to protect the national interests of Russia.

The ban applies to strategic enterprises, Russian credit institutions, fuel and energy companies that manufacture equipment and provide maintenance and repair services, suppliers of heat and electricity, and oil refineries. Also, the restriction will affect users of large Russian subsoil plots with hydrocarbon deposits with reserves of at least 20 million tons of oil, 20 billion cubic meters. m of gas or 35 million tons of coal, deposits of metals and minerals (uranium, quartz, nickel, cobalt, tantalum, niobium, beryllium, copper), as well as diamonds, gold, platinum, lithium. The list also includes offshore field developers. Separately, the document states that the ban applies to production sharing agreements for the Sakhalin-1 oil and gas project and the Kharyaginskoye field.

Transactions made in violation of the decree are considered null and void, and their owners are deprived of the rights to their shares, the document says. At the same time, operations can be removed from the ban on the basis of a special decision of the president.

The government must, within 10 days, prepare a list of fuel and energy companies and banks (in agreement with the Bank of Russia), which are subject to restrictions, follows from the document.

The restriction does not apply to an oil and gas project for the production of liquefied natural gas (LNG) “Sakhalin-2» – «Sakhalin Energy”, according to which in June Putin signed a decree on the transfer of the rights and obligations of the operator to a specially created LLC. The property of the mining company will be transferred to Gazprom or sold. This was done to protect the national interests and economic security of Russia, and also because of the “threat of a natural or man-made emergency,” the document noted. These risks arose due to “violation by certain individuals and legal entities of obligations” for the development of the Sakhalin-2 fields.

The largest offshore project

Among oil and gas companies with foreign participation, except for Sakhalin-2, the largest organization is the operator of Sakhalin-1. This is one of the largest offshore production projects in Russia and is being implemented under production sharing agreements. The project operator is Exxon Neftegas Limited, registered in the Bahamas.

As part of Sakhalin-1, four fields are being developed: Chayvo, Odoptu-Sea, Arkutun-Dagi and Lebedinskoye. The project is 20% owned by Rosneft, ExxonMobil has 30%, Japanese Sodeco has 30%, and Indian ONGC Videsh has 20%. About 11 million tons of oil are produced annually at Sakhalin-1.

Since April 26, against the backdrop of a special military operation (SVO) in Ukraine, ExxonMobil unilaterally began to phase out production. As a result, since May 15, production at the project has almost completely stopped, said yesterday “Rosneft“. On July 7, Deputy Prime Minister – Presidential Plenipotentiary Envoy to the Far Eastern Federal District Yuri Trutnev announced that production had decreased by 22 times – to 10,000 barrels per day. According to him, the stoppage of production will affect the budget of both the Sakhalin region and the entire Far East and Russia.

Another large company with foreign shareholders is developing the Kharyaginskoye field in the Nenets Autonomous Okrug. It is also carried out on the basis of the PSA. At the end of 2021, 1.56 million tons of oil were produced at the field. The project operator is Zarubezhneft-Production Kharyaga. Prior to the announcement of foreign companies to withdraw from the project, its share was 40%. The share of TotalEnergies was 20%, Equinor – 30%, Nenets Oil Company – 10%.

But on July 6, French TotalEnergies announced the transfer of its 20% stake in the PSA project to Zarubezhneft.

After the start of the NWO of Russia in Ukraine, a number of oil and gas companies from unfriendly countries, against the backdrop of sanctions, began to announce the exit from Russian assets. Mostly American and European companies spoke about leaving Russia.

The current presidential decree imposes restrictions on the activities of foreign companies in PSA projects, but foreign partners do not lose their property, said Alexei Grivach, Deputy General Director of the National Energy Security Fund. According to the expert, this is not about the nationalization of enterprises, but about protecting Russia’s energy security. As an example, the expert cited the situation with the Sakhalin-1 project, when ExxonMobil unilaterally began to curtail production, which had the most negative consequences for Sakhalin and the Far East as a whole. “This decision is largely of a reciprocal nature, the task of the decree is to ensure the further activity of PSA projects, to prevent their curtailment,” the expert emphasized.

The new presidential decree is a preventive measure taken in connection with the possible confiscation of Russian property abroad, said Sergey Suverov, investment strategist at Arikacapital. At the same time, he stressed that foreign companies still continue to own their assets in Russia, so it is incorrect to consider this step as nationalization. “This is a forced measure due to the threat of encroachments on Russian property by unfriendly states,” he stressed.

Which banks may be affected by the ban

Large foreign banks that have subsidiaries in Russia are exiting or have announced their readiness to exit Russian assets. On May 18, the French group Societe Generale sold Vladimir Potanin’s Interros its financial business in Russia, which, in addition to Rosbank, included Rusfinance Bank, DeltaCredit Bank andRosbank insurance”.

Czech investment group PPF Group and its Home Credit subsidiary, which own Russian bank Home Credit, said in May that they had sold control of the bank to a group of Russian investors.

At the end of July, the HSBC financial group entered into an agreement to sell its business in Russia to Expobank, Reuters reported. The Group is selling its 100% interest in LLC HSBC Bank (RR) (“HSBC Russia”). But the Central Bank has not received a request for a purchase, so the regulator is not exploring the possibility of such a deal, a regulator spokesman said on July 21.

In mid-March, the Austrian banking group RBI, the parent company of Russia’s Raiffeisenbank, allowed an “elaborate” exit from the Russian subsidiary’s capital. At the same time, Raiffeisenbank itself reported that they intended to continue working on the Russian market. In its half-year financial report released in early August, RBI said it was evaluating all strategic options for the future of Russia’s Raiffeisenbank, including “a carefully managed exit.”

Unicredit is considering terminating operations in Russia, but has not yet made a final decision, Andrea Orcel, chief executive officer of the Italian group, said on March 15. Later, Bloomberg, citing sources, said that the group had begun negotiations with potential buyers of the Russian business, and in early July that Unicredit was looking for an opportunity to sell the bank’s assets in Russia through a structure that would allow the subsidiary to be bought back if the geopolitical situation changes.

The American global financial corporation Citigroup (which owns Citibank) announced its desire to sell its retail business in Russia back in April 2021. In the summer of 2021, Citibank was also interested in Alfa Bank and “Tinkoff”, wrote RBC. In March, Citibank decided to expand the perimeter of the sale of business: in addition to the retail business, the business of the commercial bank department was added to the sale, and they also announced a reduction in operations and presence in the country, in particular, they stopped attracting new customers. In early June, it became known that Citigroup was negotiating the sale of part of its business in Russia with several Russian companies, including Expobank and the Reso-Garantia insurance company, the Financial Times wrote.

The current restriction on the approval of a transaction with the Central Bank when selling a share of more than 10% is not a legislative restriction, but is part of the supervision by the regulator, explains Yuri Belikov, managing director of the Expert RA agency. The presidential decree prohibiting transactions with shares in Russian banks of a higher level owned by “unfriendly” foreign companies and has an unequivocal protective legislative effect: in fact, the ban makes it impossible to quickly withdraw capital from Russia and puts all possible transactions under “manual” administrative control, he explains. .

A number of banks with foreign capital that are extremely significant on the scale of the Russian banking sector – systemically important Raiffeisenbank and Unicredit Bank, Citibank, which does not have systemic significance, but which occupies significant positions in the market – it is not beneficial for anyone that these banks were in an uncertain position without the possibility of support from the owners, says Belikov. These banks have a sufficient margin of safety for independent work and fulfillment of obligations, but they need to be determined in the short term, so it is most likely that negotiations on individual banks will continue this year, the expert believes. But the sale will be negotiated at deep discounts, he added.

Subscribe on Vedomosti on Telegram and stay up to date with the main economic and business news.

[ad_2]

Source link