Cross-border carbon tax in the EU may reduce Russia’s GDP

[ad_1]

The entry into force of the border carbon tax in the EU countries may lead to an annual decrease in Russian GDP by 0.17%, in the event of an expansion of the tax coverage, losses increase to 0.47%, according to the calculations of the Center for Macroeconomic Research NIFI. The reduction in trade turnover against the backdrop of sanctions will also lead to a decrease in the amount of tax paid, however, third countries, including China, not only can impose a similar tax, but are likely to take into account the consequences of European regulation on the export to the EU of goods produced using Russian intermediates, and demand its “purity” to reduce the amount of tax.

The entry into force of a cross-border carbon tax (TCT) in the EU may lead to a decrease in Russian GDP by 0.17%, follows from the review “EU Border Carbon Adjustment: Impact on the Countries of the Eurasian Region” by the NIFI Center for Macroeconomic Research. These are the highest losses among the EAEU countries and Uzbekistan. For Kazakhstan, the estimate is 0.01% of GDP, the same for Armenia and Uzbekistan, for Belarus – minus 0.03%.

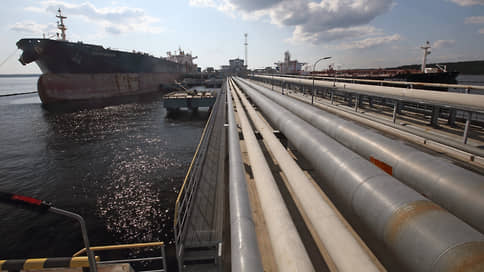

These losses will arise from the moment the border tax is actually collected. According to the current plan, from October 2023 to the end of 2025, a transitional period is envisaged, during which the EU will only require companies to submit reports, and from 2026 the latter will have to pay tax on imports of cement, electricity, fertilizers, aluminum, iron and steel (from 2029 it can be extended to chemicals, polymers, petroleum products). The calculation of the tax will take into account direct emissions from the production of intermediate products.

The NFI also estimates the maximum amount of damage if the EU countries adopt more radical measures in this area. In this scenario, the losses of the Russian Federation increase to 0.47% of GDP, Kazakhstan – up to 0.73%, Belarus – up to 0.22%, Uzbekistan – up to 0.11%, Armenia – up to 0.1%. “Introduction of TOUR for imports to the EU may have an impact on the increase in export prices and, accordingly, the volume of exports. Due to the presence of cross-industry effects, a decrease in exports in some sectors will lead to a decrease in gross output in others,” explains Sergey Sudakov, head of the Trade Policy department of the center. In particular, the introduction of TUR for the products of the ferrous metallurgy industry will lead to a decrease in the export of such products to the EU, and hence to a reduction in the gross production of the coal industry and the mining sector, the expert adds.

In Armenia, the largest payments are expected when importing aluminum foil to the EU (€10 million), in Belarus – electricity (€477.9 million), in Georgia – ammonium nitrate (€113.7 million), in Kazakhstan – oil (€887, 3 million), in Russia – semi-finished products from iron and non-alloyed steel (€7.28 billion), in Tajikistan – non-alloyed aluminum (€10.4 million), in Uzbekistan – polyethylene (€67.6 million).

At the same time, in addition to the EU countries, with which Russian trade is declining amid sanctions and restrictions in logistics, other countries, in particular, China, may introduce similar mechanisms. In the case of a potential Chinese TOUR, its initial effects on the Russian economy are likely to be different from those of the European TOUR — in addition to changing the structure of trade, the difference will be due to the fact that the price of greenhouse gas emissions in China is lower than in the EU: €7.3 per ton of CO2e in China and about €85–90 euros per tonne of CO2e in the EU, Mr. Sudakov explained to Kommersant. So far, part of the EU emission permits is issued free of charge, but this practice will be eliminated by 2034-2035.

If China introduces such a border carbon adjustment tool on the same parameters as the European TOUR in its current form, then the measure will affect 2.8% of Russian exports, the experts of the center estimate based on data on mutual trade for 2021 (in which China’s share in foreign Russian trade accounted for 13.9%). If the border tax is extended to all goods that are produced in sectors characterized by a high risk of carbon leakage, this figure will rise to 87.2%. However, even if the country itself does not introduce such a tax, Chinese and other importers can take into account European regulations when further exporting finished products to the EU and require that the purchased Russian intermediate products are also “clean” in order to reduce the amount of tax paid on deliveries to the EU .

[ad_2]

Source link