Pharmaceutical manufacturers expect prices to rise due to higher prices for imported raw materials

[ad_1]

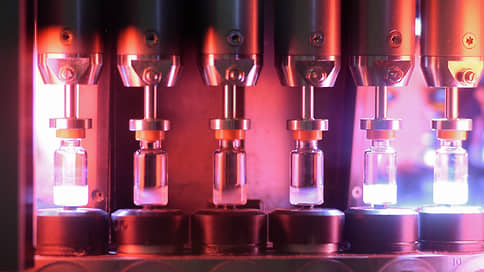

Prices for imported pharmaceutical substances are rising again after falling in 2022. According to the results of January-May, part of the positions rose in price by 40-100% year-on-year due to the devaluation of the ruble and the need to purchase substances through intermediaries under sanctions. Raising the cost of raw materials in a few months may affect the cost of medicines, analysts believe.

According to the results of January-May, compared to the same period last year, a number of positions of imported pharmaceutical substances rose in price by 1.5–2 times, interviewed analysts and market participants told Kommersant. RNC Pharma Development Director Nikolay Bespalov calls the devaluation of the ruble the main reason. According to him, the most noticeable – by 101%, up to 97 rubles. per kg – during this period, the price of sea water has risen, which is necessary for the manufacture of the Snoop nasal spray and the Linaqua nasal rinse.

Prices for dioxomethyltetrahydropyrimidine used in ointments “Metiluracil” increased by 62%, to 1.05 thousand rubles. per kg. The fraction included in the venotonic drugs Venarus and Detralex has risen in price by 57%, the acid used in the Ursosan hepatoprotector has risen by 44%, and the lactulose required for the laxative Dufalac has risen by 38% year on year, RNC Pharma notes. .

About 80–85% of Russian drugs are made from imported substances, as was calculated earlier at RNC Pharma. According to DSM Group, in 2022, the import of substances to Russia in physical terms increased by 50%, to 25.3 million kg year-on-year, in money terms — by 11%, to $2.3 billion.

According to Nikolai Bespalov, the cost of imported substances is growing after the fall in prices in 2022 by an average of 3.1%. As the expert notes, the latest round of ruble devaluation in June-July may accelerate the rise in prices for imported substances, but analysts do not expect “completely negative scenarios”.

Geropharm says that additionally, the cost of imported substances and materials for the production of substances this year is affected by sanctions. “It is not possible to find new suppliers for all positions while maintaining quality, so some of the components have to be purchased through intermediaries at prices 1.5–2 times higher,” the company explains.

In Pharmsintez, Pharmstandard, Nanolek and Binnopharm, “Kommersant” did not answer. Biocad reported that they have a full cycle of drug production. Albina Koryagina, a partner at the NEO consulting company, says that it usually takes 3-4 months between the arrival of substances at Russian factories and the release of drugs, and there should be no less time between the appreciation of the dollar against the ruble and the rise in prices in pharmacies.

Geropharm notes that the manufacturer cannot fully translate the increased costs throughout the cycle into selling prices. In 2022, the company points out, prices for vital and essential medicines (VED; the list includes Snoop spray) were increased by an average of only 9.5%. An interlocutor of Kommersant in a large pharmacy chain says that recently there have been no notifications from drug manufacturers about price increases. According to DSM Group, in May 2023, a drug package cost an average of 311 rubles, 3% more expensive than May 2022 and 13.9% more than January this year. According to AlphaRm, in January-May 2023 year-on-year, selling prices for the cough medicine Fluimucil increased the most – by 72.2%. Some of the painkillers and medicines for diabetes have risen in wholesale prices by 35-55% over the year, some positions of nasal drops – by about 25%, AlphaRm calculated.

According to Albina Koryagina, the Russian production of pharmaceutical substances is limited by the small scale of the local market. Localization is possible if it is economically viable and subject to state subsidies, says Aleksey Kedrin, Chairman of the Board of the Association of Pharmaceutical Manufacturers of the Eurasian Economic Union. Alexander Semyonov, co-owner of Active Component, adds that no more than 12 companies can actually produce pharmaceutical substances in the Russian Federation. The Ministry of Industry and Trade told Kommersant that the volume of production of substances in the Russian Federation in 2022 increased by 24% year-on-year, without giving absolute figures. They added that now 13 projects are being developed for the production of 140 positions of active pharmaceutical ingredients.

[ad_2]

Source link