Banks closed the window to Europe

[ad_1]

A year after the outbreak of hostilities in Ukraine, all systemically important banks of the Russian Federation, except for organizations with foreign capital, were subject to sanctions in one way or another. Tinkoff Bank lasted the longest, however, as a result, it ended up on the EU black list. Despite the fact that European regulators gave clients and partners of sub-sanctioned banks time to resolve relations, they may have problems, lawyers emphasize.

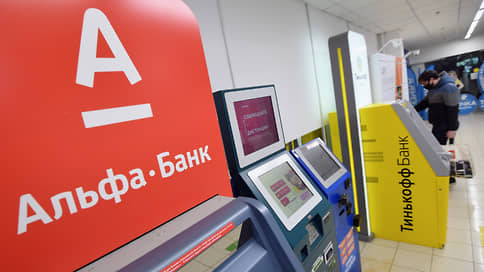

As part of the tenth package of EU sanctions, three large Russian credit institutions — Alfa-Bank, Rosbank and Tinkoff-Bank — were blacklisted. The first two banks are already on the US SDN list, so the most serious change in the status of Tinkoff Bank looks like. All funds and assets of sanctioned banks in the EU are subject to freezing, under the ban on providing funds, they will not be able to make transactions with residents of the union, “the ban also applies to funds in respect of which banks can act as nominee holders,” explains Delcredere lawyer Artem Kasumyan . However, he clarifies, the EU Council provided for the possibility until August 26 to release the funds of clients (but not the banks themselves) from third-party accounts or receive payments on securities that are legally located in the EU.

Another caveat applies to The Jewish Claims Conference, which distributes funds to Holocaust survivors, with direct payments coming from Germany. Until November 26, payments to beneficiaries in the territory of the Russian Federation through Alfa-Bank are allowed. ITSWM partner Igor Kuznets believes that in this case, “the special conditions for the existence of an organization associated with social and humanitarian programs were taken into account.”

While Alfa-Bank and Rosbank have not carried out transactions in euro for a long time, Tinkoff-Bank in December 2022 announced the resumption of transfers in this currency. Now, explains AB EMPP partner Mergen Doraev, transfers in euros through these banks will not be available, and if transactions are started, the money runs the risk of “getting stuck in correspondent accounts of intermediary banks, as has already happened.” The expert emphasizes that against the backdrop of a year of sanctions pressure and expectations of the current round of restrictions, they do not look serious. “The tenth package of the EU was discussed for so long that everyone knew in advance who the sanctions would be imposed against. The banks had enough time to prepare,” he said.

So, on February 17, Rosbank reduced its stake in RB Spetsdepository from 100% to 19%, the rest is now with Standard Trade. At the end of 2022, Tinkoff Bank reduced its stake in Tinkoff Development Center, Tinkoff Investment Technologies, Tinkoff Mobile Technologies and Tinkoff Operating Technologies from 51% to 49-49.5%.

The risks regarding the use of cards of the Chinese payment system UnionPay (UP) still look ambiguous. “The situation depends on how sensitive the UP compliance service is to European restrictions. They primarily responded to US sanctions because they have an extraterritorial effect due to the risk of secondary restrictions. We have not yet seen the position of the system in relation to EU sanctions,” says Mergen Doraev.

From the point of view of risks on the client side, the inclusion of banks in the sanctions list may complicate the transfer of funds to foreign jurisdictions, even through transit structures, Mr. Kuznets believes. Even if a client sends funds, for example, from a CIS country to Europe, he explains, and a sanction bank appears in the chain, the EU credit institution may refuse to credit funds to the account. In addition, the SWIFT operator is a European company, so the disconnection of sanctioned banks from it is inevitable. So far, the EU Council has not made any changes or additions to the regulation, which lists banks disconnected from SWIFT, Mr. Kosumyan specified.

The tenth EU package of measures also involves sanctions against the National Wealth Fund (NWF). In the case of the latter, funds denominated in euros are blocked (previously, dollar-denominated funds were blocked). €10.5 billion was placed on the NWF accounts with the Central Bank. The Ministry of Finance assured that the new restrictions would not affect the availability of the NWF funds. The Central Bank could not be reached for comment.

Another person on the EU blacklist is the Russian National Reinsurance Company (RNRC; they do not comment on the situation), whose main task is to reinsure large projects and businesses that are under sanctions. “From a financial point of view, the losses for RNPK may be insignificant, since the new restrictions were largely expected and the financial losses under the old contracts are somehow reflected in losses,” says independent expert Andrei Barkhota. “At the same time, sanctions limit new foreign economic contracts “. As a result, sanctions against RNPK may lead to the need to “reconfigure logistics routes and create new insurance mechanisms,” the expert believes. Professor of the Financial University under the Government of the Russian Federation Alexander Tsyganov emphasizes that in this case it is important to recognize the policy in foreign jurisdictions, which is of great importance in the case of cargo and ship insurance.

[ad_2]

Source link