Ore is looking for ways to China

[ad_1]

FAS may increase by one and a half times tariffs for long-distance transportation of iron ore for export through border crossings. Now iron ore exporters are trying to redirect flows to China, because before the imposition of sanctions, their main market was Europe. Analysts note that due to the turn to the east, the transport shoulder has sharply increased and, by the end of the year, the export of iron ore raw materials may fall by 40%.

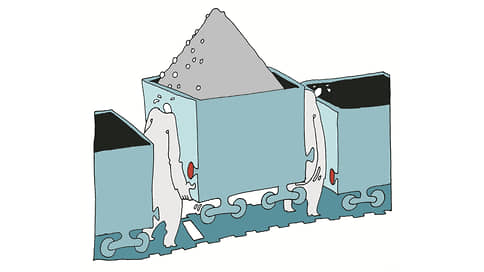

Railway tariffs for the export transportation of ores and iron ore concentrate over long distances may increase by 50%, according to the draft order on the indexation of railway tariffs published by the Federal Antimonopoly Service (according to it, freight tariffs should increase by 10% from January 1, see “Kommersant” dated 3 November). The document provides for an increase in the coefficient for the transportation of ores and iron ore concentrates for export in the direction of border stations over a distance of more than 5 thousand km from the current 0.865 to 1.3.

According to the CEP of Gazprombank, in 2021, 13 million tons of agglomerated and 12 million tons of non-agglomerated iron ore were exported from Russia. At the same time, in 2021, the volume of purchases of Russian ore by China almost doubled in price terms – from $0.6 billion to $1.2 billion for agglomerated ores and from $0.6 billion to $1.1 billion for non-agglomerated ores.

As Ilya Kolomeets, Director of Business Development and Consulting Practice at Metals & Mining Intelligence, explains, the export market for iron ore in the Russian Federation accounted for a significant share of domestic consumption (more than 20%), the largest sales destination was Europe, where 11.6 million tons were delivered in 2021. “The events of 2022 have significantly changed the nature of exports — Russian suppliers are forced to reorient volumes to remote and less cost-effective regions,” he adds. “The result was a multiple reduction in iron ore exports to Europe — by the end of 2022, it will not exceed 3 million tons.” The fall, the expert says, is observed in almost all GOKs, regardless of whether they are included in the sanctions lists. In 2022, iron ore exports from the Russian Federation are expected to decrease by more than 40%.

Logistic routes are also becoming more complicated. According to the results of the year, the transport shoulder from the GOKs to the border points is expected to grow by 24%, says Ilya Kolomeets. For a number of GOKs, the leverage has increased several times: for example, according to the analytics of Metals & Mining Intelligence, the weighted average distance of export supplies to border crossings and ports at Karelsky Okatysh of Severstal has increased by 345%, at Lebedinsky GOK of Metalloinvest – by 98% .

According to a presentation by Metals & Mining Intelligence, exports of iron ore concentrate from Russia fell by 20.3% over eight months, to 5.5 million tons. Previously, 15% of deliveries went to Europe, where Metalloinvest was the main supplier. In the same year, Europe accounts for only 4% of deliveries, while the share of export shipments to China increased from 82% to 86%. EuroChem (from Kovdorsky GOK) and the Far Eastern GOKs, traditional players in the direction, supplied 100% of their exports to China, 1.9 million and 2.8 million tons, respectively, while Metalloinvest, which shipped 1 million tons of iron ore concentrate to Europe, has not yet been able to switch to the Chinese direction. Metalloinvest declined to comment.

According to Ilya Kolomeyts, further indexation of tariffs may lead to the fact that the available export market will shrink further and the volume of deliveries will continue to decline. “Against the background of the strengthening of the ruble, the situation will be unfavorable for suppliers of ore for export,” he says. “As a more flexible mechanism, we can consider setting a “tariff limit” as a percentage of the price of products at the end station. Also, bringing the tariff component to market conditions would be facilitated by linking to market indicators based on independent price indices.” Obviously, when making a decision, it is necessary to weigh the cumulative effect on the economy as a whole, the expert clarifies: the growth of the tariff component and profits of Russian Railways must be compared with the decrease in the tax base for exporters of raw materials.

[ad_2]

Source link