Nestle raises prices for baby food

[ad_1]

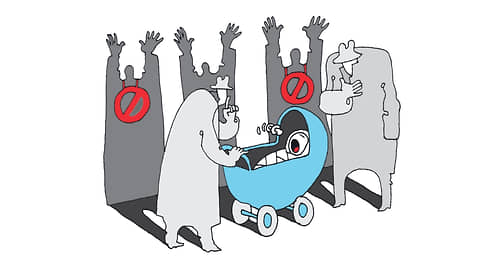

Since September, due to the devaluation of the ruble, Nestle has been raising selling prices for baby food, including breast milk substitutes, by 9%. In the current environment, retailers will have to support demand, which is declining due to the fall in the birth rate in the country, by increasing the share of promotions, experts believe. Currency instability has led to higher prices for a range of products – from chicken, turkey to coffee and tea. This exacerbates inflationary risks, which has already begun to seriously worry the authorities.

From September 4, Nestle raises selling prices for baby food by 9%, including breast milk substitutes (NAN, Nestogen, Nestle and Gerber), breakfast cereals (Nesquik, Cosmostars, Khrutka) and instant cocoa drinks, follows from available at Kommersant’s letters to retailers. Receipt of the letter was confirmed in one of the major networks. Similar notices have been sent to non-chain retail distributors, says Kommersant’s interlocutor in the market. The company itself declined to comment.

Nestle explains the increase in the price of baby food by a serious depreciation of the ruble – by more than 30% since the beginning of 2023, and in the case of cocoa drinks – also by an increase in world prices for raw materials and sugar. On the New York Mercantile Exchange, the cost of cocoa beans on August 22 reached $3.33 thousand per ton, which is 23% more than in January. The main increase in sugar prices has been observed since the beginning of this year, but since July 12, wholesale prices have fallen on average to about 60 rubles. per 1 kg, explained the source of “Kommersant” from among the sugar producers.

The Ministry of Agriculture told Kommersant that they would “further clarify” the position of Nestle. They emphasized that in general in the Russian Federation “the cost of basic raw materials for baby food and ready-made breakfasts is stable.”

Following Nestle, other manufacturers of baby food may announce price increases, NEO partner Albina Koryagina believes. The main manufacturers of breast milk substitutes in the Russian Federation, in addition to Nestle, are Danone (Tyoma, Aptamil) and InfaPrim (Nutrilak, Nutrigen, Vinny), which produced a total of about 32 thousand tons of products in 2021 with domestic consumption of 40 thousand tons. tons, says Alexei Gruzdev, CEO of Streda Consulting. Danone and InfaPrim did not respond to Kommersant’s request. Progress JSC (Fruto Nyanya) did not comment on the possible increase in prices for its products, but called such a step “predictable due to the increase in the cost of raw materials, logistics and personnel costs.”

The upcoming price increase will not fully compensate for Nestle’s costs, says Alexei Popovichev, executive director of Rusbrand (which includes baby food manufacturers). “70-80% of breast milk substitutes are produced in Russia, but raw materials are 90% imported,” he explains. For this reason, reminds Albina Koryagina, milk powders for children went up by 17% year-on-year in 2022, and growth continued in the first quarter of this year.

In 2019, the State Duma tried to initiate the possibility of including baby food in the list of socially important goods, which would allow setting maximum allowable retail prices for it. But the idea didn’t materialize. “Due to the devaluation of the ruble, whole food groups are becoming more expensive, and the baby food segment is no exception,” notes Ms. Koryagina. For example, producers of chicken, turkey, eggs, mayonnaise, tea, and coffee have recently announced price increases (see Kommersant of August 7, 9, 14, 21). On August 22, Vladimir Putin drew attention to this problem, saying that inflationary risks are growing in the country and the authorities should restrain price increases.

In addition to the increased costs in the baby food segment, there is a fundamental problem associated, according to Mr. Popovichev, with demographic factors. The declining birth rate has already led to a decline in volume sales of baby food. According to NielsenIQ, in the first half of 2022 this indicator decreased by 11.2% year-on-year, in January-June 2023 – by 2.2%. Sales of breakfast cereals in the first half of this year decreased by 15% year-on-year, while in the same period of 2022 – by 5.5%.

To maintain demand against the backdrop of rising prices, retailers can increase the share of promos in the baby food segment, says Oleg Shenderyuk, director of Yakov & Partners. In the X5 Group, Magnit, Lente, Metro did not respond to Kommersant’s request. However, Mr. Shenderyuk admits that now the share of promo is already 20-30% in non-dairy children’s products, 30-40% in dairy products, and in certain categories – 60%.

[ad_2]

Source link