In 2023, Russian coking coal is traded without export discounts

[ad_1]

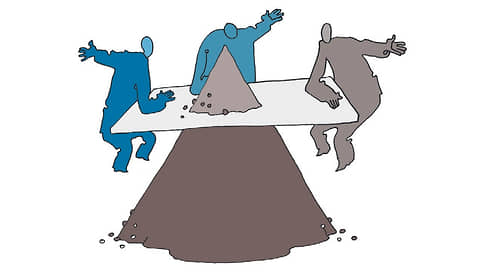

Discounts for Russian coal against world benchmarks are gradually disappearing, but not for all types of coal. According to Neft Research, coking coal is traded without discounts in all export directions. This is facilitated by the binding of blast furnaces to certain grades of coal, which makes it difficult to replace the supplier. As for energy coal, discounts remained in the western direction and, according to analysts, this situation will continue in the future.

In 2023, Russian coking coal is traded without discounts for exports, according to the presentation “Discounts for Russian Coal” by the consulting agency Neft Research (available from Kommersant).

According to the agency, during 2022, discounts for all types of coal averaged up to 35%, and for thermal coal exported from the western ports of the Russian Federation – 60%. Significant discounts emerged in April last year and peaked after the entry into force of the European embargo in September. This year, as of the end of May, thermal coal eastbound traded at a premium of $5-17 per tonne. In the Baltic, the discount is $13. Metallurgical coal is a premium: the premium on the Vostochny port-China route reaches $27.

Neft Research partner Danil Tokmin told Kommersant that discounts for metallurgical coal were gone by the end of 2022, but thermal coal still remains in the discount zone, except for the eastern direction.

The absence of discounts for metallurgical coal is explained by the fact that blast furnaces are technologically tied to certain grades of coal. As a result, switching suppliers is problematic in the short term. According to Neft Research, discounts cost Russian exporters 10-20% of lost revenue.

In 2022, coal production in Russia increased by 1.1%, to 443.6 million tons. Coal exports decreased by 7.5% to 210.9 million tons. At the moment, coal production is comparable to last year, but there is a slight decrease in exports, Russian Energy Minister Nikolai Shulginov said on May 24.

Russia was forced to redistribute the volumes of coal from Europe to the Asia-Pacific region, where 140 million tons of coal were delivered in 2022. In 2022, Russian thermal coal exports by sea increased by 10.5% compared to 2021, according to Argus.

Favorable price environment allows coal companies to increase production of coking grades.

Kuzbass enterprises increased their production by 3.2%, up to 22.5 million tons in January-April, according to the Kuzbass Ministry of Coal Industry. Production of thermal coal, on the contrary, decreased by 5.4%, to 50.5 million tons.

The main problem is still the export of coal through the Eastern landfill. The example of Mechel is illustrative: in the first quarter of 2023, the company reduced coal production by 25%, and the sale of coal concentrate by 35%. The company explained that a shortage of eastbound capacity and conventional freight restrictions prevented it from taking advantage of favorable pricing. The company’s mining assets are located in Kuzbass and Yakutia.

Given the export restrictions in the western direction, the discount on Russian thermal coal will remain, says Boris Krasnozhenov from Alfa Bank. As for coking coal, taking into account deliveries to Asia, the situation in this segment is more stable. Steel producers buy various grades of coal to optimize the charge for coking production, while new deposits with premium hard grades of coking coal are now almost not being developed.

[ad_2]

Source link